Recently, we have received a couple of queries from contractors who have never completed a starter checklist for PAYE before and are unsure which statement applies to them. Continue reading as we outline what each statement means and in which scenario it would apply to you.

What is a Starter Checklist for PAYE?

If you are starting a new job and do not have a P45, your umbrella company will ask you to complete a starter checklist. The checklist asks for vital information to help your umbrella company allocate a tax code and work out how much tax is due on your first payday.

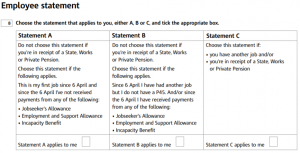

On a starter checklist, there are three statements for you to choose from:

The tax codes allocated to each statement

Depending on which statement you pick, your umbrella company will allocate one of the following tax codes to you:

Statement A – 1257L. This is the most common tax code in England and Northern Ireland and gives you the total tax-free personal allowance of £12,570. Your tax-free allowance will be given to you in equal portions throughout the year until you have received your total allowance at the end of the tax year. A 1257L tax code is a cumulative tax code which means that if you have not worked since the beginning of the tax year and get a job on the 1st July, you will be allowed three months’ worth of tax-free allowance to use against that month’s wages. After the unused allowance has been applied, you will go back to the usual allowances per period.

Statement B – 1257L Week 1/Month 1. This tax code gives you the total tax-free allowance of £12,570 given in equal portions throughout the year, but it is a non-cumulative tax code. This means that when you are paid, your tax is calculated based on what you receive in the current period and does not take into account any previous earnings or tax paid – even if there are some unutilised tax-free allowances. For example, if you start a new job on the 1st July, you will be given one month’s worth of your tax-free allowance to use against July’s wages.

Statement C – BR. BR stands for Basic Rate and means all your income from this source is taxed at 20%.

If you do not complete the starter checklist, your umbrella company will allocate you an 0T tax code. An 0T tax code means you do not have any tax-free personal allowance and could result in you paying more tax than is necessary.

What happens if I select the wrong statement?

Depending on which statement you select, it could result in an overpayment or underpayment of tax. More often than not, problems usually arise when statement A is selected, when statement B or C is more applicable. This is best illustrated by way of the example below:

Louise is working as a nurse for the NHS. She decides to pick up some temporary shifts at the hospital she works at in her spare time with an agency. When Louise joins, she is told her payroll will be processed by an umbrella company, and she is asked to complete a starter checklist.

Louise will be doing the same role in the same hospital she usually works at; she ticks statement A as she hasn’t done any other work since the 6th April. As she has ticked statement A, the umbrella company allocate a 1257L tax code to use against her earnings.

Over the year, Louise earns £5,000 from work she has done through the agency – none of which is taxed as it falls below the £12,570 tax threshold. However, Louise has already used the £12,570 tax-free allowance on her regular earnings. This means that Louise will receive a bill from HMRC at the end of the year for underpaid tax on her additional earnings.

Despite both roles being in the same place, doing the same job and working for the NHS, the agency is a separate organisation for payroll purposes. If Louise had ticked statement C instead of statement A, she would have been allocated a BR tax code, and a 20% tax rate would have been applied on her additional earnings from the agency, which would have given the correct result.

Common scenarios which can cause confusion

If your situation does not directly fall within any of the three categories, it can be challenging to decide which statement to pick. We’ve put together a list of common questions we get asked by contractors completing the starter checklist to help you determine which statement applies to you.

“I’ve just moved to the UK but worked in my home country before I moved. Which statement applies to me?”

If this is your first job since moving to the UK and you have not received any form of taxable income since becoming a UK tax resident, Statement A would be the most appropriate option. Please be aware; if you receive foreign income whilst living and working in the UK, you may be required to complete a UK tax return to report your earnings to HMRC.

“I’ve been self-employed up until now. I don’t know which statement I should pick.”

The ‘job’ mentioned in Statements A to C in the starter checklist refers to employment only; any previous self-employed contracts can be ignored for the checklist.

“I receive benefits other than the ones listed. Does this matter?”

No, only the taxable benefits listed affect the statement you should pick in the starter checklist.

“I have had another job since the 6th April, but I was paid cash in hand. Do I still pick statement B?”

The ‘job’ mentioned in Statements A to C are referring to employment only. If the job you performed was on a self-employed or casual basis and you have received no taxable benefits since 6th April, then statement A would apply in this instance. If the job were undertaken on an ’employed’ basis, then statement B would apply.

“I’ve not worked since the 6th April but have been receiving furlough payments. Should I pick statement A?”

Whilst you have not technically worked, Furlough payments are taxable. Therefore, statement B would be a better option to pick to ensure you do not underpay tax.

Are you interested in registering with Umbrella Company UK?

Umbrella Company UK has helped hundreds of contractors with their payroll, and we look forward to welcoming you to our service. To find out more about Umbrella Company UK and to request a free, tailored take home pay illustration, please complete the short form here or contact our Sales Department on 01707 669023.